insurance companies automobile car insured affordable car insurance

insurance companies automobile car insured affordable car insurance

On the other hand, a chauffeur with a poor driving record must choose for a reduced deductible. Wondering exactly how to examine my driving document? The most convenient way to examine the driving document is by contacting your licensing office or neighborhood DMV. On top of that, many states have actually made driving records readily available online. affordable.

Opting for the appropriate deductible quantity, relying on your demands as well as financial situation, can assist you save hundreds on your vehicle insurance coverage (risks). If you pick between an automobile insurance coverage deductible of 500 or 1000, think about various aspects highlighted in this post as well as discuss your alternatives with your insurance policy agent (liability).

insurance companies insure cheap car insurance cheaper car insurance

insurance companies insure cheap car insurance cheaper car insurance

Instead, do appropriate research study as there are other ways to decrease insurance costs. risks. Your vehicle insurance agent can evaluate your circumstance and also determine the very best possible savings alternatives for you. What is far better: a greater or lower insurance deductible for cars and truck insurance coverage? If your car insurance coverage budget plan is tight, a high-deductible plan might be better for you.

What is the most effective accident deductible? It's finest to have a $500 collision deductible unless you have a big amount of financial savings. cheap. Remember, this insurance deductible amount needs to be paid each time you make an accident insurance claim - insured car. What is the disadvantage of having a greater deductible? A major disadvantage of a greater insurance deductible is that you might not be able to afford a bigger loss.

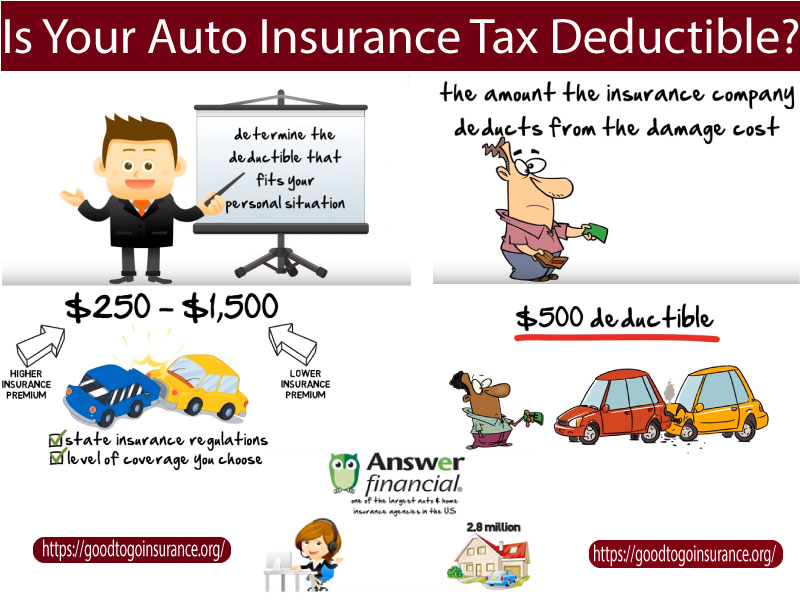

You may have asked yourself before, exactly how do insurance deductibles function? What are the different kinds of deductibles, and also does the quantity impact the monthly repayments? In simple terms, an insurance deductible is the quantity of money you dedicate to pay of pocket prior to your insurer begins to pay you any type of benefits - car insurance (vehicle) (risks).

What Is Visit this site An Insurance Deductible? Can Be Fun For Everyone

As an example: Claim you have an insurance deductible of $500 as well as you rear end someone. auto insurance. If you are the at-fault chauffeur, the protection will have to originate from your collision policy - cheaper auto insurance. If your problems are $2000, you will have to pay the $500 insurance deductible as well as after that your insurance coverage will certainly pay the staying $1500 (low-cost auto insurance).

You would pay the full $400 and your insurance would not pay anything, due to the fact that you did not reach the insurance deductible. Various kinds of deductibles: A deductible can be a fixed amount or a portion of the overall cost of your case. cars. The instance above makes use of a fixed deductible. This number is something you will set with your insurer prior to you sign your plan.

If you pick a higher deductible your costs price will be reduced - cheaper car insurance. Just remember, if you select a high deductible, you require to contend least that much cash saved in situation you enter into an accident and need to pay it. low cost. Where to discover your deductible: If you already have an insurance plan, you can discover the amount of your insurance deductible on the main page of your policy, recognized as the (cheap car).

business insurance cheap accident cheaper car

business insurance cheap accident cheaper car

It is near the front of your plan. money. Check to see what your insurance deductible is, as well as if you have any kind of problem finding it or any kind of various other concerns at all, call an Infinity agent at! - cheapest car insurance.

We are so delighted you asked! This is an important inquiry one that numerous people address once and also never stop to review as their situations change. What is an insurance coverage deductible? An insurance coverage deductible is the quantity of money you have to pay from your own pocket prior to your insurance protection starts.